Invoicing

In Membri 365, during the various operations, invoices are automatically generated by the system.

However, several processes still require your intervention.

- Read an invoice

- Create an invoice

- Find an invoice

- Pay an invoice

- Send an invoice

- Account statements

- Cancellations and refunds

- Create a credit note

- View an account's invoice credit balance

- Frequently Asked Questions

- Fields details

Read an invoice

Invoice Types

| Invoice Types | Description | Invoice Types | Description |

|---|---|---|---|

| Member Registration | Billing a new member registration results in the creation of a membership pending payment as well as a member registration invoice. | Delegate Registration | Invoices of the Delegate Membership type are generated from the page of the same name when adding a new delegate on an already active membership. |

| Order | Order type invoices are generated from the Orders page of the Sales section of the main menu. When an Order type solicitation is won, an invoice of the same type is generated. | Donation | Donation type invoices are generated from the page of the same name after creating a donation. |

| Event Registration | Event Registration invoices are created after registering for an event in your environment through a manual registration or through our integrated ticket office. | Contract | Invoices of the Contract type can only be created from a won solicitation of the same type. |

| Manual | Invoices created from the Invoices page of the Billing section of the main menu are manual invoices. | Annual Sponsor | When an Annual Sponsor type solicitation is won, an invoice of the same type is generated. |

| Event Sponsor | When an Event Sponsor type solicitation is won, an invoice of the same type is generated. | Refund | Refund invoices are created when invoice are cancelled. |

| Renewal | When a renewal is approved, a membership awaiting payment and a renewal invoice are created. | Delegate renewal | |

| Opening balance | Membership upgrade | Invoices created when upgrading a membership |

Invoice Statuses

An invoice status changes. It is possible to consult the status of an invoice in its header.

| Statuses | Definitions |

|---|---|

| New | The invoice is newly created in the system, but it is not yet invoiced. |

| Pending Payment | An invoice that has been created and sent, but the account has not yet paid. |

| Paid | A payment has been applied to the invoice and the balance is $0. |

| Completed | The invoice is paid and transferred to the accounting system. |

Invoice Information

The Invoice information section contains all the general information related to the invoice itself.

| Fields | Description |

|---|---|

| Invoice Ref. | The default reference number is 001000, with each new invoice, this number increases by 1. Therefore, the higher the number, the more recent the invoice. The reverse is also true. |

| Synchronization Reference | Invoice number in accounting system |

| Original Document Number | This field is used to display membership notices numbers or for event registrations numbers . |

| Name | This is the name of the invoice. |

| Invoice Type | Invoices can be of several types: renewal, membership, manual, registration, etc. |

| Currency | The system default is Canadian dollars |

| Taxless | This option allows you to not apply tax on an invoice. It is not possible, for the moment, to activate this option only for certain lines of your invoice. You cannot therefore combine non-taxable products and taxable products. |

| Block Invoice Email | Enable this field to prevent Membri 365 from emailing the invoice. |

| Last Email Sent On | This is the date of the last invoice email sent. |

| Description | It is possible to add a personalized message on the invoice that you send by email. |

Billing Information

The section Billing information contains all the information related to the billing of an account

| Fields | Description |

|---|---|

| Account | This search field allows you to select an account that is part of your database. Use the partial search using the asterisk to be effective. Most of the fields in this section are pre-filled when you select the account since the account file contains all the information that allows us to bill it. |

| Override Billing Email | This field allows you to indicate an e-mail address different from the one displayed in the account file. |

| Email Address | This field is pre-filled in several cases. If it is not, the invoice will be sent to the email that is registered in the account card. |

The fields in this section are pre-filled in connection with the billed account sheet. The changes you make directly on the invoice will not have any impact on the information found in the account file.

The Invoice Products section contains all the products that have been invoiced. It is possible to select them to know the general information.

Consult the Products page for more information on this subject.

Create an invoice

To create a manual invoice, follow these steps:

- Navigate to the

Invoicespage in the main menu (1) - Select

+Newin the toolbar to create a new invoice (2) - Enter the general information of the invoice which are also mandatory fields (if in doubt, the fields of an invoice are all described in the previous section) ( 3)

- Select

Savefrom the toolbar to create the invoice in the system (4) - Select

+ New invoice productin the section Invoice products (5) - Fill out the Quick creation: Invoice product form by selecting an existing product or by creating a new product. (6)

- Select an existing product

- Use the magnifying glass of the search field to have access to all the products in your product list

- Select the product

- Determine the quantity purchased and the unit price (if the latter is not already configured)

- Select

Save and closeto return to the invoice

- Create a new product

- Name your product and indicate the price

- Determine the quantity purchased

- Enter the G/L number or the product number (it depends on your accounting system) in which the amount of this line of your invoice will be entered

- Select

Save and closeto return to the invoice

- Select an existing product

- Add other products to the invoice by repeating steps 5 and 6 as needed

Remember that it is not yet possible to create an invoice that combines taxable and non-taxable products.

- Select the

Invoiceoption in the toolbar to send the invoice by email (7)

Find an invoice

There are several ways to quickly find an invoice that was created in Membri 365:

1. In an account file

To quickly view open invoices:

- Access the file of an account that you have billed

- Select the

Billingtab - Consult the open invoices of the account

To view all invoices related to this account:

- Select

Associationin the header - Select

Invoicesin the list of associated elements - Navigate in the different system views, use the quick search or impose filters on columns to find the invoice that interests you

2. In invoice lists

Navigate to the

Invoicespage in the main menu to have a list of all invoices that have been created in the systemNavigate in the different system views, use the quick search or impose filters on columns to find the invoice that interests you

From here you can search either by invoice name, invoice reference number (Membri 365 number or your accounting system number) or charged account.

You can do a partial search using the asterisk (*). For example, if you enter: *4900, all results with these numbers will appear.

Pay an invoice

Make a regular payment

- Select the invoice on which to apply a payment

- Select the

Paymenttab

If you have a customer's credit card information, you can pay directly on the online payment platform instead. Simply select Pay Online from the toolbar. Then complete the payment steps on the platform.

- Select

+ New Payment - Enter the information related to the payment in the form Quick creation: Payment

Depending on the payment method, the Details field may be mandatory. For example, a confirmation number is entered therein in the case of a payment by credit card or the check number when the payment is made by check.

- Select

Save and closeto return to the invoice Refreshto apply the payment to the invoice and to see the new balance displayed

Apply available invoice credits

To find out if the account has invoice credits available, you must consult the account file.

- Select the invoice on which to apply a credit

- Select the

Paymenttab - Indicate Yes in the field Apply available invoice credits

- If necessary, determine the maximum amount of invoice credits that can be used to pay the balance of this invoice

Apply available contribution credits

This module is not yet available. It will be in the next versions of Membri 365. You can activate it from the parameters of your environment.

Some bills can be paid by applying contribution credits. These credits can result from canceling an event attendance or be part of membership option package benefits.

- Select the invoice on which to apply a credit

- Select the

Paymenttab - Indicate Yes in the field Apply available contribution credits

- If necessary, determine the maximum amount of contribution credits that can be used to pay the balance of this invoice

Send an Invoice

Invoices are mostly sent automatically in Membri 365, but you may choose to block the automated sending and then send the invoice manually at your preferred time. It is also possible to resend an already sent invoice manually without any issues.

You can resend an invoice directly via the application or by downloading the invoice and sending it manually.

Send the Invoice via Membri 365

Sending the invoice via Membri 365 updates the Last email sent on field in the Invoice Information box to facilitate your follow-ups.

- Find the invoice to send or resend to the client and select it;

- Select the

Resend emailoption in the toolbar.

Download the Invoice

- Find the invoice to send or resend to the client and select it;

- Select the

Download invoiceoption in the toolbar to download the file in PDF format; - Use your preferred messaging system to communicate with the client and attach the invoice.

Send the Invoice to the Record Owner

You can send the invoice directly to the record owner. By default, the record owner is the user responsible for creating the invoice. You can change the owner of the invoice by reassigning the record to another user.

The email is sent to the owner regardless of whether the invoice email is blocked or not. Sending the invoice to the owner allows you to verify the email format and easily follow up with your client directly from your inbox.

- Find the invoice to send or resend to the owner and select it;

- Select the

Send to owneroption in the toolbar.

Account Statements

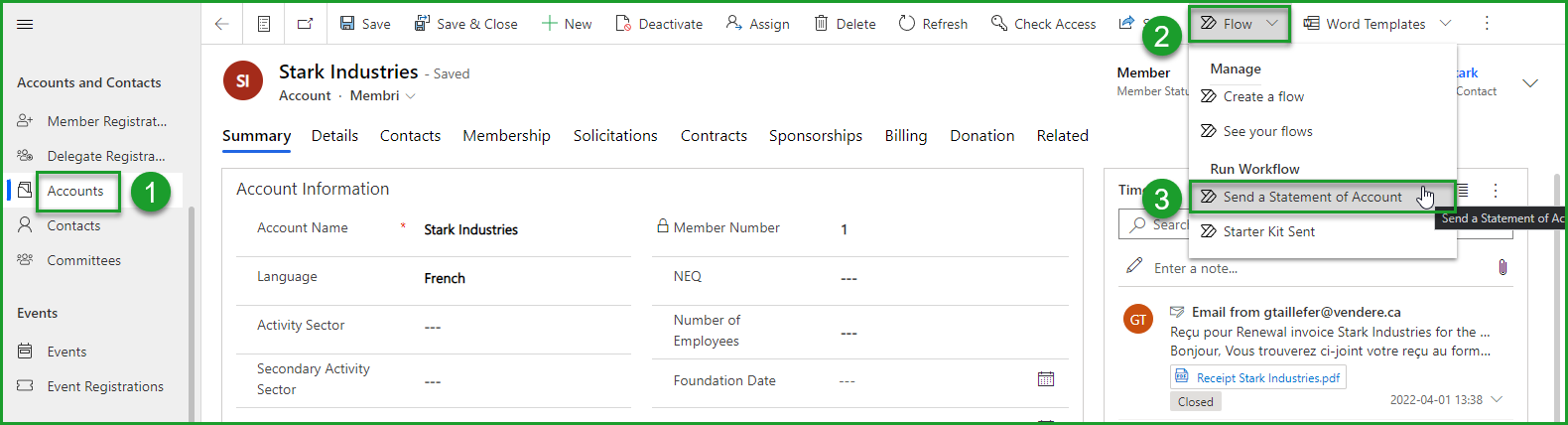

Sending or Downloading an Account Statement

You can send or download account statements from your Membri 365 environment.

If an account has multiple unpaid invoices and you want to send an account statement, you can do so manually. Once the option is selected, the email will be sent to the account's billing email address, and the send will be added to the timeline.

- Navigate to the account record;

- Select Send Account Statement;

- Select Download Account Statement.

Enabling Automatic Sending of Account Statements

This option is not enabled by default in Membri 365. Contact our support team to activate it.

Understanding the Automatic Sending Process

You can enable the automatic sending of account statements for all accounts in your environment that have open invoices generated more than 30 days ago.

Account statements are sent every 30 days.

If an invoice has been Pending Payment for more than 30 days, an account statement is sent to the account. After this send, no account statement will be sent for the next 30 days. After 30 days, the system reassesses if an invoice has been unpaid for more than 30 days. If it has, the system sends a new account statement on that date.

Upon activation, account statements are automatically sent to each account that has an open invoice for more than 30 days. Therefore, you need to closely monitor unpaid invoices to avoid any surprises. For example, you may have forgotten to apply a payment to an invoice, causing unnecessary confusion during the automatic sending of an account statement.

Excluding an Account from Automatic Account Statement Sends

Excluding an account from automatic account statement sends ensures that the account will not receive any account statements, even if it has unpaid invoices for more than 30 days.

- Select the account you want to exclude;

- Go to the Billing tab;

- Set the Do Not Send Account Statements field to Yes;

- Save.

Excluding an Invoice from Account Statements

Excluding an invoice from account statements allows you to follow up on an invoice that should not be sent to an account via account statements. This gives you the necessary time to perform the necessary checks related to the invoice, without having to completely stop sending account statements.

- Select the invoice you want to exclude;

- Go to the Summary tab;

- Set the Exclude from Account Statement field to Yes;

- Save.

Cancellations and Refunds

Canceling an invoice can lead to two distinct behaviors depending on the status of the invoice, and it is important to understand these differences to ensure proper account and refund management:

Cancellation: Cancel an unpaid invoice:

The system cancels the invoice without requiring manual follow-up.

Depending on your environment's configurations, the invoice may be marked as Canceled or generate a cancellation invoice. A "cancellation invoice" is a new invoice associated with the original one that cancels it. A refund payment is applied to both invoices, ensuring adequate accounting tracking for monthly reports or accounting synchronization.

Refund: Cancel a paid or partially paid invoice:

The system creates a refund invoice associated with the account, requiring manual follow-up.

Unlike a cancellation invoice, a refund invoice will have a negative unpaid balance upon creation and will generate a billing credit available on the account. From this point, you have two options:

- Use the billing credits on another pending invoice;

- Refund the customer manually and apply a refund payment to the invoice.

Paying an invoice associated with a membership process involves multiple operations in the system, so canceling it is not straightforward. Refer to the section cancel a paid membership invoice.

Cancel an Unpaid Invoice (Cancellation)

- Find the pending invoice you want to cancel;

- Select the

Cancel Invoiceoption in the toolbar; - Confirm the invoice cancellation.

It is possible to cancel an event registration at various percentages for a partial refund.

Cancel a Paid or Partially Paid Invoice (Refund)

This procedure does not apply to membership or renewal invoices that have been paid. It only works for other paid invoices in your environment.

When the invoice is paid, it is possible to issue a refund.

The invoice will not be canceled. When the invoice is paid, this button creates a refund invoice in your environment that will be linked to the paid invoice you want to refund. This refund invoice has a negative balance. This indicates that you need to issue a refund.

You could also decide not to refund the account. In this case, the negative balance of this invoice is added to the account's billing credits. You can use these credits to fully or partially pay the account's future invoices.

- Select the invoice to refund (1);

- Select

Cancel Invoicein the toolbar (2); - Refund the member in the most convenient way (check, bank transfer, etc.).

Once the refund is complete, you need to indicate that you have processed the refund on the refund invoice by applying a negative payment to this invoice.

In Dynamics, negative numbers are displayed in parentheses. If you enter a negative number in the Amount field, it will be automatically formatted this way.

- Select the refund invoice;

- Select the Payments tab;

- Select

+ New Payment; - Select the payment method Refund and include details on how you processed the refund;

Remember that the system does not transfer funds when the refund is entered. You must process the transfer through your chosen method.

- Select

Save and Closeto apply the payment; - Select

Savein the toolbar and return to the summary tab to see the new balance of $0 and the new Paid status of the invoice.

Cancel a Paid Membership Invoice

If you mistakenly applied a payment to an invoice related to a membership fee for an account, you cannot simply cancel the payment, as paying this type of invoice (membership, renewal) activates a pending fee.

However, it is possible to achieve a similar result with a few steps.

In Your Accounting System

- Make the corrections manually in your accounting system

- Cancel the previous invoice

- Cancel the payment if necessary

In the Membri 365 Environment

- Select the account in error;

- Select the Membership tab and set Intervention Required at Renewal to Yes;

- Describe the situation of this account in the Reason for Intervention Required field for future reference;

- Select the active fee (the one activated by the payment you want to cancel);

- In the Start Date and End Date fields, enter the same dates as the previous fee;

- Wait for the renewal tool to generate a new renewal;

The renewal tool runs in the background at 15-minute intervals. If nothing generates, the tool may not be activated. To activate it, go to the environment settings.

- Select the new renewal;

- In the Invoice Message field, indicate that the invoice produced by approving this renewal is a new invoice and that there was an error with the initial invoice payment;

- Select Approve in the toolbar to generate a new renewal invoice and a new pending fee;

- Apply a payment or wait for the account to pay the invoice.

When the invoice is paid, the new fee activates. You will still have a duplicate fee in the account's fee history, but you can identify that one of them resulted from an error based on the messages you left on the invoice and renewal.

Create a credit note

It is possible to create a credit note using the invoicing module.

- Select the

Invoicespage in the Billing section of the main menu - Select

+ Newto create a new invoice in your Membri 365 environment - Select the account for which you need to create a credit note and enter the various information required for invoicing in the boxes of the Summary tab (for more information on the various fields of this tab, refer to the section Read an invoice)

- Select

Savein the toolbar to create the note in the environment and have access to the Invoice Details module - Select the three superimposed dots in the upper right corner of the Invoice Details section and select

+ New Invoice Product - Complete the various mandatory and optional fields of the quick form for creating products

Positive amounts represent amounts that are owed to your organization. Negative amounts therefore correspond to cash outflows that you must repay to the account in question. The amount of the credit note must therefore be negative.

You should also know that negative amounts are always displayed in parentheses.

- Select

Save and Closeat the bottom of the Quick Form to create it.

You may want to set the Block Invoice Email field to Yes to avoid sending this note by email.

- Select

Billin the toolbar to create the note and add it to the account's file.

Invoices pending payment (status that your credit note will have until the full payment of the balance) are always displayed in the Billing tab of an account's file.

It is possible to note each of the transactions to the balance of the credit note by applying negative payments on the (negative) balance of the credit note to each transaction.

It is not enough to enter a refund in Membri 365 for it to be made. Indeed, the CRM allows you to track this information, but does not transfer funds.

Issue a refund

If the status of the invoice is Awaiting payment, all you have to do is cancel the invoice for it to be deleted from the environment.

When the invoice is paid, it is possible to make a refund.

This procedure does not work for membership invoices or for paid renewal invoices. However, it works for all other paid invoices in your environment.

- Select the invoice to be reimbursed

- Select

Cancel Invoicefrom the toolbar

The invoice will not be cancelled. When the invoice is paid, this button creates a reimbursement invoice in your environment which will be linked to the paid invoice that you wish to reimburse. This refund invoice has a negative balance. This tells you that you need to issue a refund.

You could also decide not to reimburse the account. In this case, the negative balance of this invoice is added to the account invoice credits. It is possible to use these credits to fully or partially pay the next invoices of this account.

- Reimburse the member in the way that suits you the most (cheque, bank transfer, etc.)

You will soon be able to refund invoices paid online directly. This feature will be available in a future version of our application.

You must then indicate that you have made the reimbursement on the reimbursement invoice by applying a negative payment to this invoice.

- Select the reimbursement invoice

- Select the Payment tab

- Select

+ New Payment

The Dynamics way of displaying negative numbers is to put them in parentheses. If you write a negative number in the Amount field, it will automatically be displayed that way.

- Select the method of payment by which you reimbursed this invoice and enter the details of the transaction if necessary.

The system does no funds transfer when the refund is entered. You will have to make this transfer by the means of your choice.

- Select

Save and closeto apply the payment. - Select

Savefrom the toolbar and return to the summary tab to see the new $0 balance and the new Paid status of the invoice.

View an account's invoice credit balance

It is possible to apply these credits to an invoice to pay it.

- Select an account file

- Select the

Billingtab - Consult the Total available credits field in the Billing information section.

To recalculate the total amount of available credits, simply select the calculator to the left of the field and select Recalculate.

Frequently Asked Questions

How to Add Multiple Recipients in CC

You can add recipients in CC when you override the billing emails on the invoice.

- Select the invoice for which you want to add recipients in CC;

- Set the Override Billing Emails field to Yes;

- Enter the primary email for sending;

- Add the other recipients in CC, separating each address with a semicolon (e.g., support1@vendere.ca;support2@vendere.ca;support3@vendere.ca).

Field details

The reading key helps you better understand the vocabulary used in this section.

If necessary, use the quick search command on your keyboard Ctrl + F to target the terms you are interested in.

| Term used | Explanation |

|---|---|

| Allows | Fields that can be modified to perform a specific task |

| Displays | Field information that cannot be changed |

| During | Indications related to an important milestone related to the field |

| If | Prior Action or Other Field Condition |

| Warning | Important information not to be overlooked in relation to the field concerned |

Tab - Fields Summary

Section - Invoice information

| Fields | Description |

|---|---|

| Invoice Ref. | Displays the invoice reference number generated in Membri 365. |

| Synchronization Reference | Displays the invoice reference number in the accounting system. |

| Original Document Number | If the invoice was generated by a different entity; Displays the original document number related to the creation of the invoice. |

| Name | Allows you to change the name of the invoice. |

| Invoice Type | Displays the invoice type. Indicates from which entity the invoice was generated. |

| Member Registration | If the invoice type is a member registration; Displays the member registration related to this invoice. |

| Delegate Registration | If the invoice type is a delegate registration; Displays the delegate registration linked to this invoice. |

| Renewal | If the invoice type is a renewal; Displays the renewal for this invoice. |

| Annual Sponsor | Whether the invoice type is an annual sponsor; Displays the annual sponsor linked to this invoice. |

| Contract | If the type of invoice is a contract; Displays the contract for this invoice. |

| Order | If the invoice type is an order; Displays the order for this invoice. |

| Event | If the invoice type is an event; Displays the event related to this invoice. |

| Event Registration | If the invoice type is an event registration; Displays the event registration for this invoice. |

| Event Sponsor | If the invoice type is an event sponsor; Displays the event sponsor linked to this invoice. |

| Donation | If the invoice type is a donation; Displays the donation related to this invoice. |

| Membership Upgrade | If the invoice type is a membership upgrade; Displays the membership upgrade for this invoice. |

| Billed on | Displays the date the customer was billed. |

| Main Chapter | Displays the chapter used for the invoice. Allows you to edit the main chapter used for the invoice. |

| Currency | Displays the currency used for the invoice. |

| Taxless | Warning, this field applies to all products of the invoice. Displays whether the invoice uses taxes on the products of the invoice. During the creation of a manual invoice; Allows you to create a taxless invoice. |

| Accounting Project Number | Allows you to add a project number to the invoice for the accounting system. |

| Sale Type | Displays the type of sale made. This field is used mostly for sales targets. |

| Original invoice | If the invoice was generated by another invoice; Displays the invoice linked to this invoice. This field appears on invoice cancellations. |

Section - Email Information

| Fields | Description |

|---|---|

| Block Invoice Email | Allows you to block the email of this invoice from being sent. |

| Last Email Sent On | Displays the date of the last email sent regarding this invoice. |

| Description | If you used the [%Description%] token in personalizing your billing email or PDF; Allows you to customize the message that will appear on the token on the email and/or PDF of this invoice. |

| Additional Attachment | Allows you to add an additional attachment to the invoice email. The attachment will be uploaded to the invoice and will remain available there. |

| Override the invoice template | Allows you to override the default email template for invoices and apply the email template of your choice for this invoice. |

| Override Display Language | Allows you to choose whether you want to override the default display language for sending this invoice. |

| Display Language | If the Override display language field is set to Yes; Allows you to choose the display language used to send this invoice. |

Section - Billing Information

| Fields | Description |

|---|---|

| Account | Displays the account linked to this invoice. |

| Billing Account Name | Allows you to change the account name displayed on the invoice. |

| Salutation | Allows you to change the title that will be used for the billing contact when sending this invoice. |

| Function | Allows you to change the function that will be used for the billing contact when sending this invoice. |

| Billing Contact Name | Allows you to change the name that will be used for the billing contact when sending this invoice. |

| Address | Allows you to change the address that will be used when sending this invoice. |

| City | Allows you to change the city that will be used when sending this invoice. |

| ZIP/Postal Code | Allows you to change the postal code that will be used when sending this invoice. |

| Province | Allows you to change the province that will be used when sending this invoice. |

| Country | Allows you to change the country that will be used when sending this invoice. |

| Override Billing Email Address | Allows you to override the email address that will be used for billing when sending this invoice. |

| Email Address | If the Override billing email field is Yes; Allows you to enter the email address to use when sending this invoice. |

Tab - Payments

Section - Payments

The fields mentioned below are displayed only if the invoice balance is greater than 0.

| Fields | Description | Fields | Description |

|---|---|---|---|

| Apply Available Invoice Credits | Allows you to apply the invoice credits available on this invoice. | Apply Available Membership Credits | Allows you to apply the membership credits available on this invoice. |

| Specify Invoice Credit Amount | If the Apply Available Invoice Credits field is set to Yes; Allows you to specify the number of invoice credits used for this invoice. | Specify Membership Credit Amount | If the Apply Available Membership Credits field is Yes; Allows you to specify the number of membership credits used for this invoice. |

| Invoice Credit Amount | If the Specify Invoice Credit Amount field is set to Yes; Allows you to choose the number of invoice credits. | Contribution Credit Amount | If the Specify Membership Credit Amount field is Yes; Allows you to choose the number of membership credits. |

Tab - Refund

The tab appears if it is a manual invoice that has been billed or if the invoice has already generated a refund.

Section - Refund

| Fields | Description |

|---|---|

| Credit Invoice | Displays whether the invoice has been credited. If the invoice has not yet been credited; Allows you to apply a credit to the invoice. |

| Percentage To Credit | Displays the percentage of the invoice that was credited. If the invoice has not yet been credited; Allows you to specifY the percentage to be credited on the invoice. |

| Refund Invoice | Displays the cancellation invoice generated by the credit on the invoice. |

Tab - Accounting

Section - Accounting

| Fields | Description |

|---|---|

| Synchronization Reference | Allows you to change the reference number of this invoice with your accounting system. |

| Synchronization Status | Allows you to change the synchronization status of this invoice. |

| Sync Error | If the Synchronization Status of the invoice is set to Transfer Error; Displays the error code related to the transfer error. |

| Batch number | Indicates the batch number for batch synchronization in accounting software SAGE 300. |

| Batch Item Number | Indicates the batch item number for batch synchronization in accounting software SAGE 300. |

| Account receivable | |

| Billed on | Displays the billing date and time for this invoice. Allows you to change the billing date and time for this invoice. |

| Error on Automatic Payment | Displays if there was an error on the automatic payment. |

| Error on Automatic Payment Return | Displays if there was an error on the return of automatic payment. |

Section - Tax Group

| Fields | Description |

|---|---|

| Tax Group | Displays the tax group used for this invoice. During the creation of a manual invoice; Allows you to choose the tax group to use for this invoice. |

| GST | If the tax group applies GST/HST; Displays the percentage used to calculate the GST. |

| QST | If the tax group applies QST/PST; Displays the percentage used to calculate the QST. |

| Tax Calculation Type | Displays the type of tax calculation used. |

Still unsure? Contact us - support@vendere.ca